Qualified Retirement Plans & IUL Comparison

Indexed Universal Life (IUL) vs. Qualified Retirement Plans (like 401(k)): A Comparison

Indexed Universal Life (IUL) insurance and qualified retirement plans like a 401(k) serve different primary purposes, the major purpose is tax deferral, in other words you do not pay taxes until your retirement years, think about this for a moment, when asked, would rather pay taxes on the seed or the harvest, most say the seed. Your Retirement Plan is a Tax Code Not an Investment Here are some of the key IRS tax codes related to qualified plans:

The Usual Suspects

Loss of Principal

Outliving Your Money

Need Income To Keep Up With Inflation

Taxes On Income

Same applies to all tax deferred plans including traditional IRA’S, SEP IRA, 457, 403(b) and much more. Most don’t know these plans are NOT investments, they are IRS tax codes.

IRS TAX CODES:

In the context of US tax law, “qualified plans” refer to retirement plans that meet the requirements outlined in specific sections of the Internal Revenue Code (IRC). These plans receive favorable tax treatment, including tax-deferred growth of earnings and potentially taxdeductible contributions, to encourage individuals to save for retirement.

Here are some of the key IRS tax codes related to qualified plans:

- Internal Revenue Code Section 401(a): This is the primary section defining a qualified retirement plan. It sets the standards plans must meet, including requirements for participation, vesting, nondiscrimination, contribution limits, and distributions.

- Internal Revenue Code Section 401(k): This section covers cash or deferred arrangements (CODAs), known as 401(k) plans. It allows employees to defer salary, which is tax-deferred until distribution.

- Internal Revenue Code Section 403(a): This section relates to qualified retirement annuity plans.

- Internal Revenue Code Section 403(b): This pertains to tax-sheltered annuities (TSAs) for employees of public schools, tax-exempt organizations, and ministers.

- Internal Revenue Code Section 408(k) (Simplified Employee Pension - SEP): This governs SEP plans for small businesses and self-employed individuals, involving employer contributions to SEP IRAs.

- Internal Revenue Code Section 408(p) (SIMPLE IRA): This covers Savings Incentive Match Plans for Employees (SIMPLE) IRAs, another option for small businesses with both employee and employer contributions.

- Internal Revenue Code Section 457(b): This applies to eligible deferred compensation plans of state/local governments and tax-exempt organizations.

- Internal Revenue Code Section 415: This sets limits on contributions and benefits for qualified plans.

- Internal Revenue Code Section 402(g): This section sets the elective deferral limit for plans like 401(k)s, 403(b)s, and 457(b)s.

- Internal Revenue Code Section 411: This establishes minimum vesting requirements.

- Internal Revenue Code Section 401(a)(9): This section dictates required minimum distribution (RMD) rules.

- Internal Revenue Code Section 416: This outlines requirements for top-heavy plans.

The IUL can be considered as retirement savings strategies. Here's a comparison based on the provided search results:

| Feature | Indexed Universal Life (IUL) | Qualified Retirement Plans (e.g., 401(k)) |

|---|---|---|

| Tax Treatment | Contributions made with after-tax dollars. Cash value grows tax-deferred. Policy loans/withdrawals can be tax-free if structured properly. Death benefit is generally tax-free to beneficiaries. The Key, is properly engineered IUL will not only mitigate future taxes meaning recover the taxes you payout on retirement funds, more importantly more money in retirement all tax-free. |

Traditional 401(k): Pre-tax contributions (tax-deductible). Growth is

tax-deferred. Withdrawals in retirement are taxed as ordinary

income. Roth 401(k): After-tax contributions. Qualified withdrawals are tax-free. Mandatory Required Minimum Distributions as of current age 73 |

| Investment Growth |

Linked to market index performance with a cap on gains and a floor to

protect against losses. IUL policies also have features like

participation rates (which determine how much of the index's gains are

credited to the policy), caps (which limit the maximum interest

credited) or no caps gains, and floors (which protect against losses,

often with a 0% floor). Available Index Options: • S&P 500: A widely recognized stock market index representing 500 of the largest publicly traded companies in the U.S. • Russell 2000: A stock market index that tracks the performance of 2000 small-cap companies. • Bloomberg US Dynamic Balance III ER Index: A balanced index designed to offer potential for growth and stability. • PIMCO Tactical Balanced ER Index: Another balanced index, potentially offering different investment strategies. • Blended Futures Index: An index that combines different futures contracts, potentially offering diversification. • Global Indexes: Some IUL policies offer access to a broader range of global stock market indexes. • Volatility Control Indexes: These indexes aim to manage risk by adjusting exposure based on market volatility. • And many more: Morgan Stanley, Goldman Sachs, Gold Commodity, BlackRock... |

Direct investment in market-based options (mutual funds, ETFs, etc.).

No caps on returns, but also no downside protection from market

downturns. Yo-Yo Syndrome, up, then down, crash then

hope for recovery. Have you ever considered the time to recover if at

all and the loss opportunity from the money you lost waiting to

recover?

|

| Access to Funds | Access to cash value through policy loans or withdrawals at any age without federal penalty taxes (loans are tax-free if structured properly). | Limited access before age 59½, generally subject to a 10% penalty plus ordinary income taxes (exceptions may apply). Funds held hostage until 59½ all taxable throughout retirement. |

| Contribution Limits |

No government-imposed limits. Based on insurance regulatory guidelines

and financial underwriting. What is a Properly Engineered (or Max-Funded) IUL?  A "properly engineered" or "max-funded" Indexed Universal Life (IUL)

insurance policy is designed to maximize cash value accumulation

while still providing a death benefit and preserving tax

advantages.

A "properly engineered" or "max-funded" Indexed Universal Life (IUL)

insurance policy is designed to maximize cash value accumulation

while still providing a death benefit and preserving tax

advantages.

Key characteristics: • Minimized initial death benefit: This reduces policy expenses, specifically the cost of insurance (COI), which increases as the insured ages. • Maximum premium funding: Contribute the maximum allowable premium each year to accelerate cash value growth. This is done within IRS guidelines to avoid the policy becoming a Modified Endowment Contract (MEC), which would negatively impact its tax advantages. • Properly engineered no MEC ever happens • Increasing death benefit: The death benefit may be structured to increase over time as the cash value grows, contributing to the policy's efficiency. • Focus on cash value growth: Unlike traditional universal life insurance policies that primarily emphasize the death benefit, a properly engineered IUL prioritizes the cash value component as a wealth accumulation tool. How it works: • A portion of the premium payment goes towards the cost of insurance, and the rest is allocated to the cash value component. • The cash value can earn interest based on the performance of a chosen market index, like the S&P 500, with a floor (typically 0%) protecting against market losses and a cap limiting potential gains. • By focusing on maximizing contributions while minimizing the death benefit and COI, the policy aims to generate significant cash value accumulation that can be accessed tax-free through loans or withdrawals. Important Considerations: • Complexity: IUL policies are complex and require careful consideration of their various features, including caps, floors, participation rates, and fees. • Tax implications: While the cash value grows tax-deferred, and loans or withdrawals can be tax-free, it's crucial to understand potential tax consequences, especially if the policy lapses or becomes a MEC. Again "properly engineered" no tax implications ever. • Long-term commitment: IULs are designed as long-term financial strategies and may be designed for short term Maximizing cash value growth requires: • Regular premium payments: Consistent payments ensure steady growth. When engineered properly it is not uncommon to have seven figures tax free • Optimal allocation: Choose index accounts that align with your risk tolerance and growth objectives. • Monitoring and adjustments: Periodically review and adjust allocations to optimize growth potential. • Minimizing fees: Be mindful of policy fees and charges to maximize net GROWTH |

Strict annual limits set by the IRS ($23,500 in 2025, plus catch-up

contributions for those age 50+). Key 2025 Contribution Limits: • 401(k), 403(b), 457(b) (Employee Contribution): $23,500 (under 50), $31,000 (50+) • 401(k), 403(b), 457(b) (Total Contribution - Employee & Employer): $70,000 (under 50), $77,500 (50+) • IRA (Employee Contribution): $7,000 (under 50), $8,000 (50+) • SEP IRA (Employer Contribution): Lesser of $70,000 or 25% of compensation • SIMPLE IRA (Employee Contribution): $16,500 (under 50), $20,000 (50+) • SIMPLE IRA (Employer Contribution): Matching up to 3% of compensation or 2% of compensation • Catch-up Contributions (60-63 years old): $11,250 for 401(k), 403(b), and 457(b) plans • Annual Compensation Limit: $350,000

|

| Fees | Can have higher fees, especially in early years, including insurance costs and administrative charges. Proper design avoids MEC, maximizes net growth. | Generally lower fees, especially with low-cost index funds. |

| Employer Match | No employer matching contributions. No limits. No contribution to Uncle Sam on matching funds. | Employer matching contributions are a common benefit. Taxable. So much emphasis by employees on employer contribution/match. Another IRS benefit-Taxes. Tax bracket x the $1.00 match = tax/loss. "Contributing to Uncle Sam" |

| Required Minimum Distributions (RMDs) | No RMDs. | Generally required at age 73. |

| Flexibility | Allows adjustments to premiums, death benefit, and potential for tax-free income via policy loans. | Less flexibility regarding withdrawals before retirement. |

| Death Benefit | Yes, generally received income tax-free by beneficiaries. | Account balance is taxable to heirs as income. "Inherited IRA" Non-spouse beneficiaries, in most cases, must withdraw the entire inherited IRA balance within 10 years of the original owner's death. |

IUL Strategy & The Marvel of Tax-Favored Accumulation

In Summary: Combining Strategies for Optimal Results

Many sources suggest that combining both a 401(k) (at least up to the employer match) and an IUL can be a beneficial strategy for retirement planning. This approach can provide:

- Tax diversification

- Protection against market downturns

- Flexible access to funds

- Tax mitigation on future taxes in retirement

- Death benefit for beneficiaries

⚠️ Important: It's crucial to consult with an IUL specialist before making a decision; highly recommended to determine the best approach for your specific circumstances and financial goals in designing and engineering your IUL so all IUL "gears" work simultaneously. This is the key for unprecedented tax-free wealth.

What is a Properly Engineered (or Max-Funded) IUL?

A "properly engineered" or "max-funded" Indexed Universal Life (IUL) insurance policy is designed to maximize cash value accumulation while still providing a death benefit and preserving tax advantages.

Key Characteristics of a Properly Engineered IUL:

- Minimized initial death benefit: This reduces policy expenses, specifically the cost of insurance (COI), which increases as the insured ages.

- Maximum premium funding: Contribute the maximum allowable premium each year to accelerate cash value growth. This is done within IRS guidelines to avoid the policy becoming a Modified Endowment Contract (MEC), which would negatively impact its tax advantages.

- Increasing death benefit: The death benefit may be structured to increase over time as the cash value grows.

- Focus on cash value growth: Unlike traditional universal life insurance policies that primarily emphasize the death benefit, a properly engineered IUL prioritizes the cash value component as a wealth accumulation tool.

Maximizing Cash Value Growth Requires:

- Regular premium payments: Consistent payments ensure steady growth.

- Optimal allocation: Choose index accounts that align with your risk tolerance and growth objectives.

- Monitoring and adjustments: Periodically review and adjust allocations to optimize growth potential.

- Minimizing fees: Be mindful of policy fees and charges to maximize net growth.

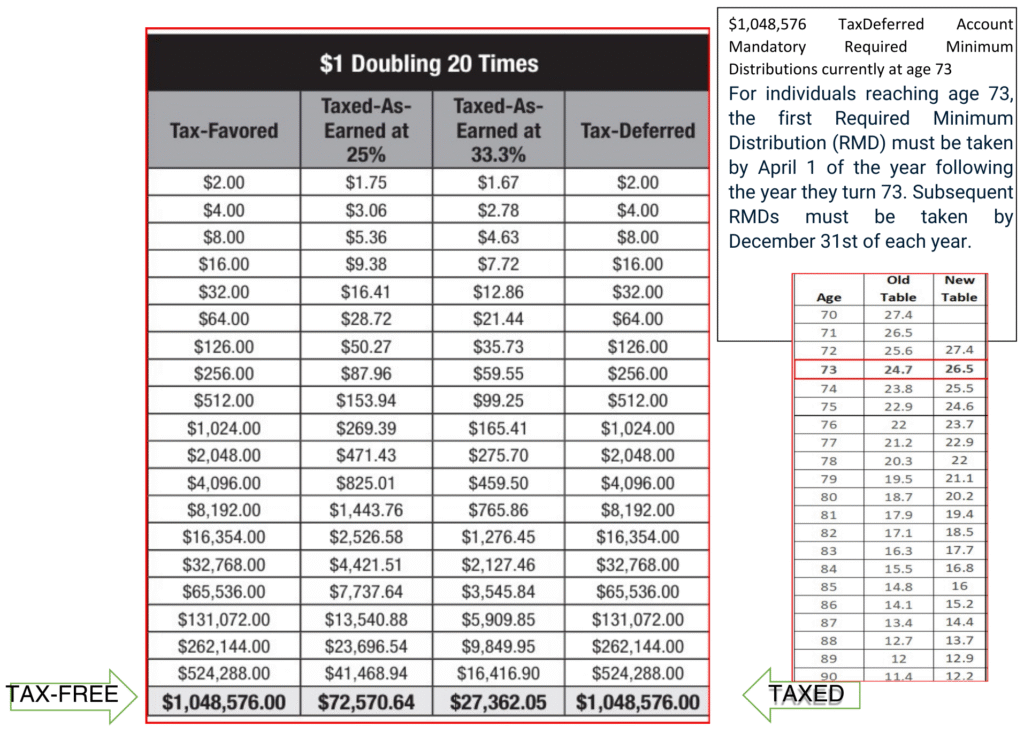

The Marvel of Tax-Favored Accumulation

Once you grasp the power of compound interest, you're ready to see how it relates to the next marvel: tax-favored accumulation. Let's compare money compounding in a tax-favored versus taxed-as-earned environment.

The Power of Doubling: A Simple Example

Imagine you start with one dollar; yes, just one little dollar, that will double every period for twenty periods in a tax-favored environment.

Believe it or not, that $1 will grow to $1,048,576. That's the power of compound interest in a tax-favored environment!

The Formula for Doubling

220 = 1,048,576

Starting with $1 and doubling it 20 times in a tax-favored (tax-deferred or tax-free) environment gives you exactly $1,048,576.

Why Tax-Favored Matters

In a tax-favored environment (like a Roth IRA, Health Savings Account, or Indexed Universal Life), all growth compounds without yearly tax interference. Here's why that's so transformative:

| Scenario | Starting Amount | Growth Pattern | After 20 Periods |

|---|---|---|---|

| Tax-Favored | $1 | Doubles every period | $1,048,576 |

| Taxed-as-Earned | $1 | Gains taxed each period | Significantly less |

Every time your money doubles in a taxable account, a portion of the gain is lost to taxes—meaning you can't compound on the full amount. That interruption dramatically reduces growth over many periods.

The Marvel Unveiled

- Exponential growth: Doubling 20 times yields over a million-fold increase.

- Tax efficiency matters: Tax-free compounding amplifies each doubling. No taxes mean each period builds on a larger base figure.

- Real world impact: Imagine doubling over years or decades—the difference between taxable and tax-favored accounts can be hundreds of thousands or even millions of dollars.

In a Nutshell

The "miracle" of compound interest becomes even more powerful when your growth is untaxed at each step. Your money doesn't merely grow—it explodes exponentially without any leaks. That's why tax-favored vehicles are often called marvels for savvy savers.

🎯 Key Takeaway: Tax-favored accumulation isn't just beneficial—it's transformational for long-term wealth building.

Would you like to see how real-world scenarios look—like a Roth IRA versus a taxable account over 30 years? Let’s break it down.

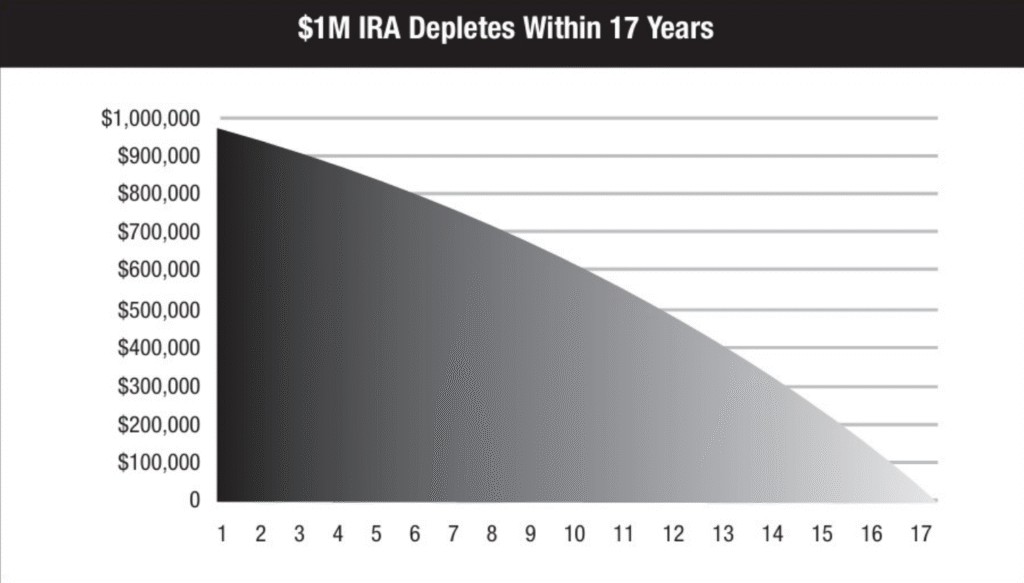

In a survey 61% of boomers surveyed said they feared outliving their retirement money more than they feared death). Why is this such a big fear? Because it will be a reality for far too many Americans. As you can see in Figure where the million-dollar nest egg is depleted within 17 years, taxes can have a profoundly negative impact on retirement income. If your retirement planning vehicle is tax-free during the harvest that million-dollar nest egg earning 7.2% would allow you to withdraw $72,000 per year tax-free and never deplete your million-dollar principal. This is why it’s important to optimize when and minimize how much you’re taxed—

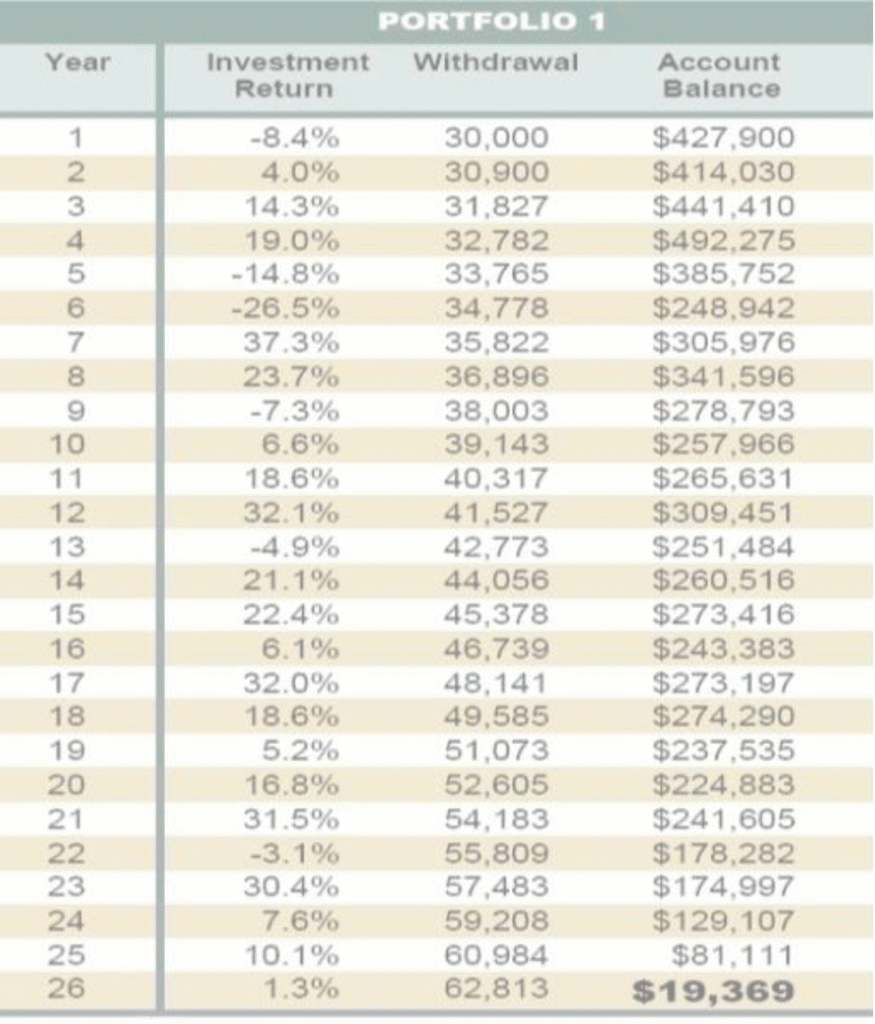

Portfolio 1

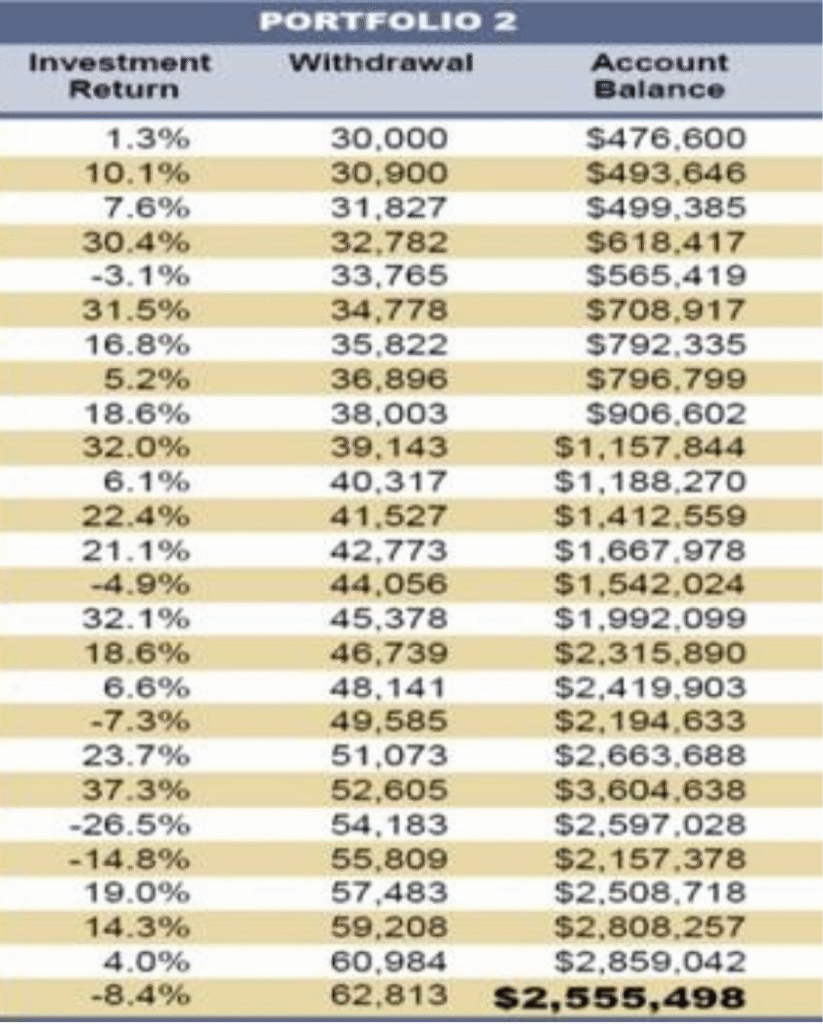

Portfolio 2 Money for Life + Beneficiary Tax Free Lump Sum